Beat the Market and Get Extraordinary Growth By Timing and Time In the Market

We’ve talked about buying free standing houses to achieve average growth which outstrips average growth in apartments 1.5 times, we’ve talked about buying development sites…what about timing the market? Isn’t this a thing?

Sort of. Time in the market is a thing, but so is timing the market. Property moves in cycles and as we’ve seen in Perth, the cycle can take a damn long time to come around again. When buying then, we want to make sure we’re buying in an up market so that we can capture the growth from the upswing in the micro cycle, then if things plateau for a few years at least we’ve got our money’s worth initially.

The ideal scenario is buy on the upswing, harvest equity to buy another property in a market on the upswing as well, then do it again, and again. This is in an ideal world so it may take longer than the few sentences it takes to describe it, but if things go well we could potentially grow our portfolio of 6 to 8 houses in less than a decade from timing the market well, and then it’s time in the market that will make the difference.

We can see from the above ABS graph that the 10 year average increase in value is 83.9%, so not quite doubling. It’s time in the market which gives this incredible outcome, after all Warren Buffett’s favourite holding time for an investment is forever.

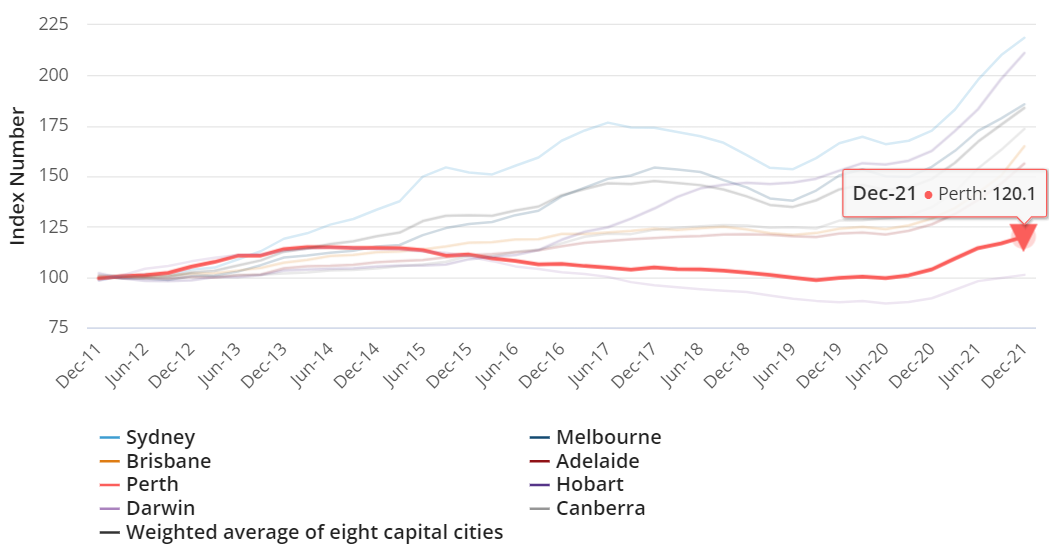

You can see from the below graph that Perth basically tanked from June 2014 to June 2020. That’s 6 long years of sidewards or backwards movement, so you’d want to make sure if you bought in Perth in the lead up to June 2014, that you captured as much of the upswing as possible to make that 6 year holding period bearable.

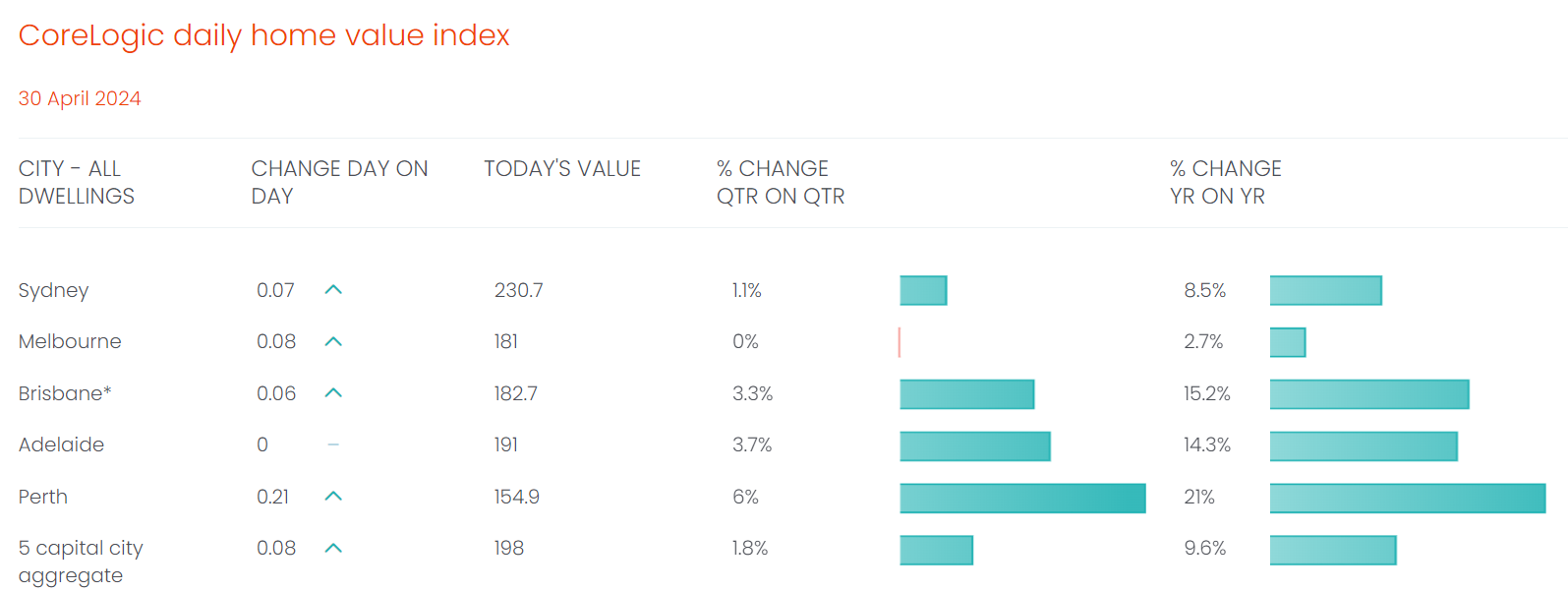

Unfortunately the ABS stopped publishing the above graph so this December 2021 data is the last that we have, however below Core Logic have a similar graphic based on 2007 as a base year. We can see that Perth values have increased 54.9% since 2007, which if we’re to take the average of 83.9% average growth from the ABS as the benchmark, then we still have a fair way to go in Perth to catch up to the average. This means we’re still in good shape to capture the upswing in this part of the cycle to harvest the equity to buy again. The above graphs show that even though we’ve seen such massive growth the last 24 months, we’re still only partway through this cycle.