Housing Growth Outstrips Wage Growth 2:1

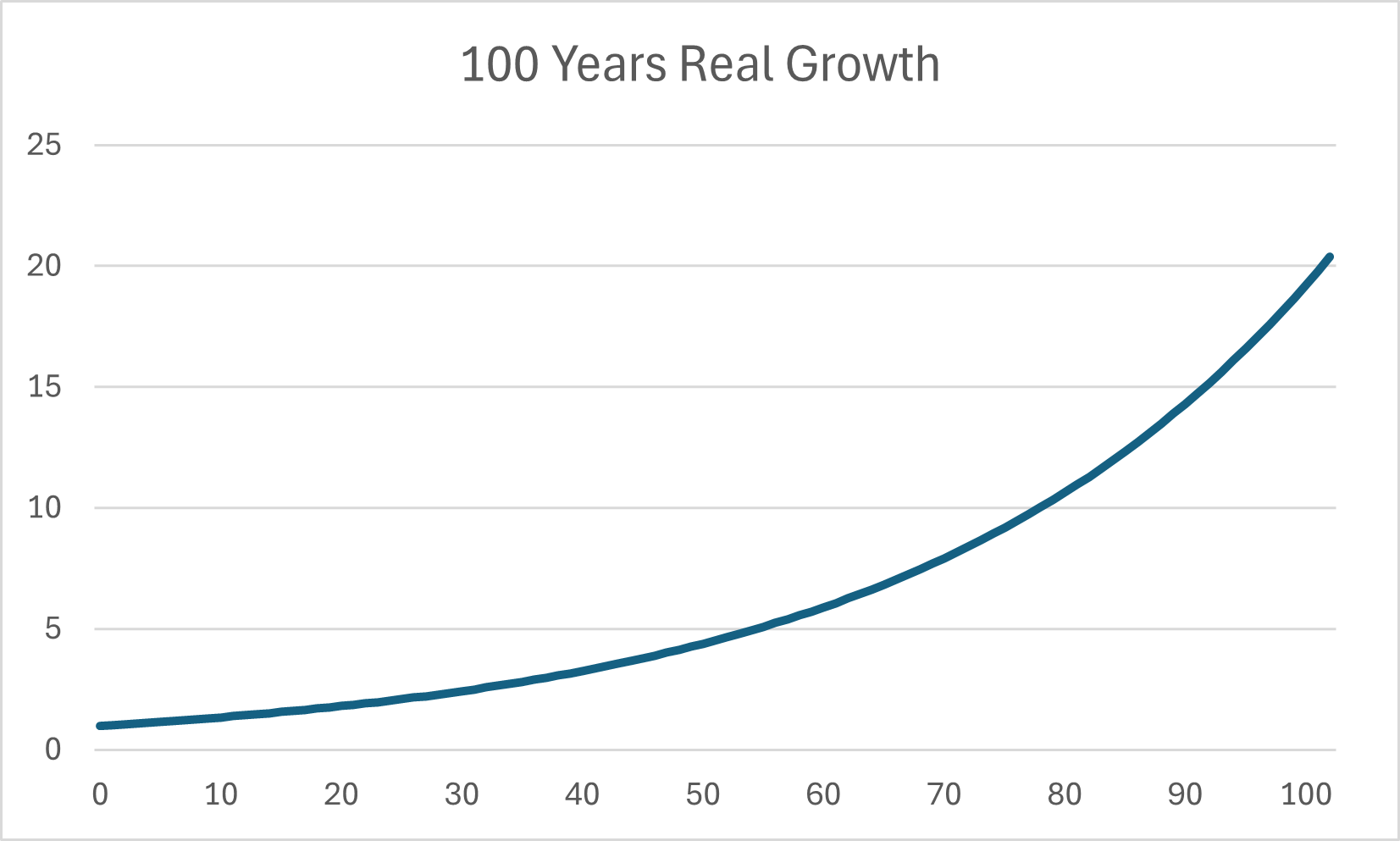

CoreLogic released an article recently explaining that their Home Value Index has increased 150% over the last 20 years, however according the ABS wage growth has only been 82%. The growth in housing has almost outstripped wage growth 2:1 which reflects that real growth in housing outstrips inflation on average by 3%, meaning real growth in houses is is close to 100% (doubling) around 24 years.

We can use real growth as a proxy for affordability of housing. There will always be a portion of the population who will be lifelong renters. Making some broad assumptions, if affordability is the key reason for this demographic renting long term, every 25 years we can assume the number of people who find owning a house unaffordable doubles.

We can see from the above graph that over the long term, if real growth in housing price outstrips inflation by 3% then this means a proportionate reduction in affordability. We’ve seen this play out in mega cities such as New York, London, Japan and Beijing: it’s almost impossible for an ordinary person to buy a house because it is simply unaffordable. We’re at the beginning stages of this happening, but make no mistake it will happen in Australia, it’s already happening in Sydney, and it will eventually happen in Perth as well.

Now is the time to get into the market. Contact me if you would like help to create life changing, generational wealth through property.