Beat the Market and Get Extraordinary Growth with this 1 Simple Strategy pt 2

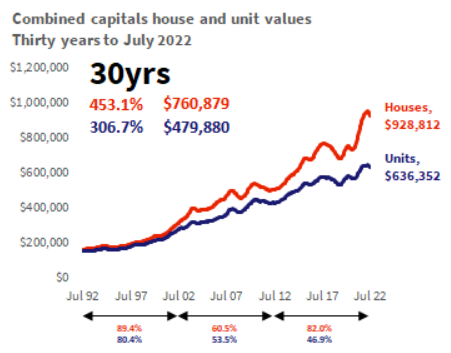

Housing in Australia grows on average 7% per annum over the long term, this varies depending upon who measures it, what data sources are used and the time period over which it’s measured, generally speaking though this is the number that is thrown around. However this is a very high level statistic, how do we break this down to understand the micro dynamics of the property market and beat the average to achieve extraordinary growth?!

We saw in the previous post that growth in houses outstrips growth in units over 30 years 1.5 times, meaning the house value growth will double the unit value growth over 40 years.

So it’s a no brainer that we should be buying free standing houses…how then do we ensure that the freestanding houses we’re buying are going to grow faster than the market in general so that we don’t have to wait as long to achieve financial freedom?

There are many, many ways to tackle this question, some of which we’ll look at but 1 very simple method that ANYONE can understand and implement when buying a house, is to buy a house that has development potential.

This ensures that we’re hitting the the long term average growth that most other houses in the country are hitting, PLUS we can then stack strategies, meaning buy and hold achieving 7% compound annual growth rate, until it makes sense to then supercharge the return, develop and achieve an outsized return on your investment.

Reference for graph

https://www.corelogic.com.au/news-research/news/2022/the-long-game-30-years-of-housing-values