Why Perth Right Now?

What are the basics of Supply and Demand in property?

1. Supply/Demand Balance: Fewer properties and more buyers lead to price increases.

2. Bidding Wars: Competition among buyers drives prices up as they offer more to secure properties.

3. Seller's Market: Low supply empowers sellers to set higher prices.

4. Investor Demand: Investors' interest further boosts demand, escalating prices.

5. Perceived Value: Scarcity enhances property value, prompting buyers to pay more.

6. Market Confidence: Low supply signals a robust market, increasing buyers' willingness to pay higher prices.

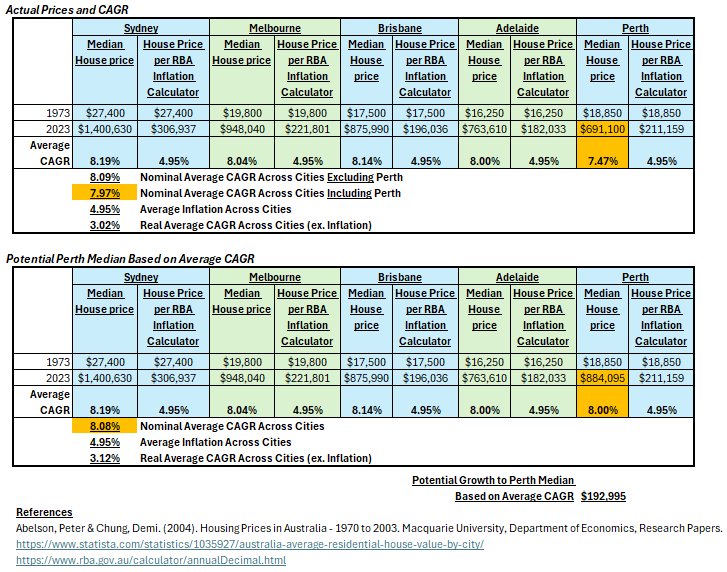

Depending upon the time period picked and your source (CoreLogic, RBA or ABS for example) the long term compounding annual growth rate for property in Australia can be defined as 3% in real terms (excluding inflation) to 5-8% nominal (including inflation). Inflation has an official target of 2-3% but is actually much higher as we’ve seen recently, and as you can see in the below example it actually averages 4.95% over the last 50 years from 1973 to 2023 per the RBA’s own inflation calculator!

The typical value that is thrown around and generally accepted by most commentators is 7% nominal (including inflation). Most people are familiar with the statement “property doubles in value every 7-10 years”. What most people aren’t aware of is that this typically happens in short, sharp and fast bursts. We saw this in Perth in the early 2000s, we saw this in Sydney in the early 2010s and we’re seeing it again now in Perth after almost a decade of stagnation.

You can see the Perth median price in December 2023 was $691,100 according to www.statista.com which represents an average compound annual growth rate over the 50 years from 1973 to 2023 of 7.47%, well below the average of the 4 other major capital cities of around 8%. Using these numbers, for Perth to be in alignment with the long term averages of the other major capital cities we need to see the median grow to $884,095 which will bring the CAGR back to 8%. That’s an increase of $192,995 or another 28% on top of $691,100!

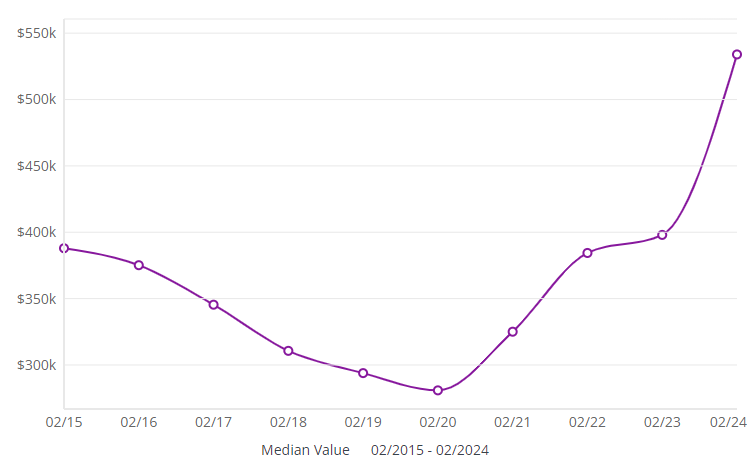

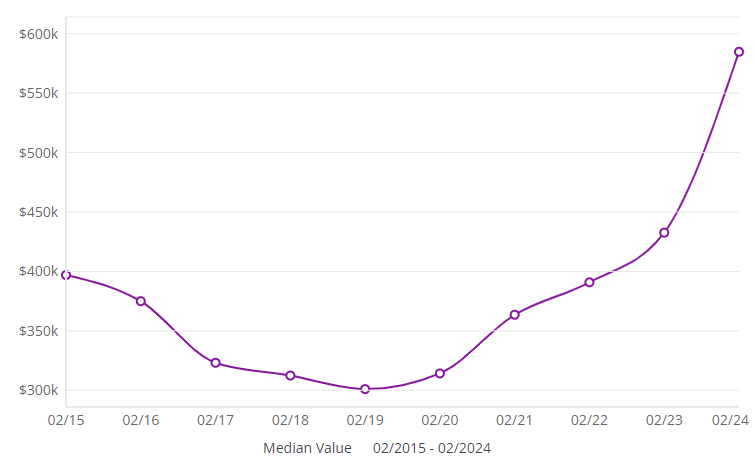

As we expect property prices to grow on average 7% per annum, Perth still has a lot of catching up to do. This first graph shows the median values of the suburb Maddington for the last 10 years (courtesy of www.onthehouse.com.au). The median in February 2015 was $387,924 and the median in February 2024 is $533,980. If the median of Maddington had grown at 7% over a 10 year period until now, it would be $763,105. You can see we’re well below that, currently sitting at an annual compounding growth rate of closer to 3.25%. This is common across most of Perth, see below 3 graphs of a random selection of suburbs with medians under $600,000 all have similar start and end prices, showing a similar compound annual growth rate around 3%.

I’m not saying that the median in Maddington or other similar priced suburbs will jump up to $763,105 in the next 12 months, but I am saying there is a lot of room for growth to still be within the bounds of what is considered “normal”.

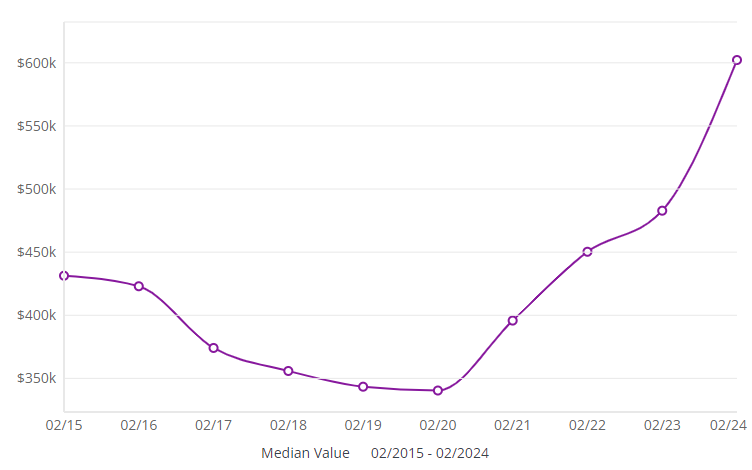

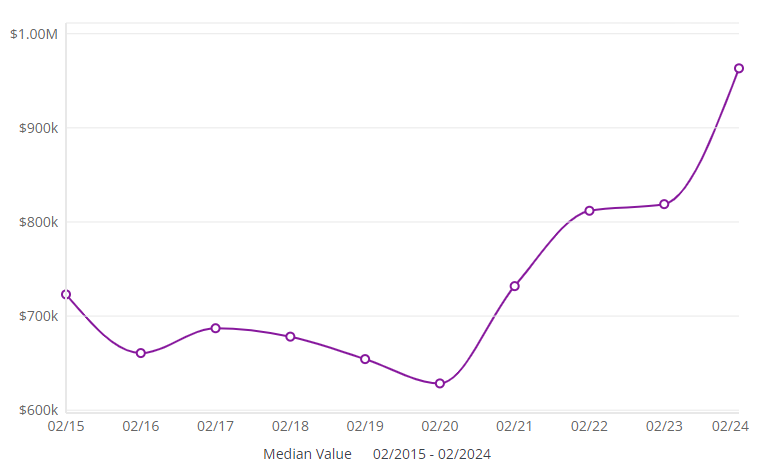

You might be thinking “sure, those are the cheaper suburbs where everyone can afford to pay more for a property, what about the higher valued suburbs?”. Next, let’s look at Doubleview, starting with a median of $723,043 in February 2015 and ending with a median $963,216 in February 2024. That shows a compound annual growth rate of approximately 2.9%, if Doubleview had grown at 7% for the last 10 years the median would be more like $1,422,335. Again, I’m not saying I expect Doubleview to catch up and have a median of $1.4m in the next 12 months, but there is plenty of room to grow before we start getting alarmed that things are unsustainable or above long term trends.

Below are 3 more random suburbs that started around the $700k mark in 2015 and still haven’t hit the $1.4m they need to be at to be align with the long term growth rate of 7%.

Let’s take a look at the cost of renting in Perth. Rents have jumped up massively in the last 2 years. Take a look at Maddington median prices over the last 10 years against the median rents for the last 10 years. We can see at rents increase, so too do the prices.

We can see why when we look at the cost of renting against the cost of paying a home loan. If we were to purchase the median house in Maddington $533,980 at 80% LVR and 6.5% interest rate, the debt would be $427,184. Fortnightly repayments would be $1,245 which translates to $623 per week. The average house in Maddington rents between $550 and $650 per week so we can see why a lot of renters are jumping across to being home owners. As the rents increase, owning your own home for the same repayment amount seems much more palatable than paying someone else’s mortgage off.

And now the same thing with Doubleview…unsurprisingly this is consistent across most suburbs we’ve look at in Perth. The sharp increase in rent prices correlates with a sharp increase in median values. Repayments on the median house price purchased for $963,216 at 80% LVR, debt being $770,572 and interest rate of 6.5% would be $2,246 which translates to $1,123 per week. You can comfortably pay upwards of $1,000 for a rental in Doubleview.

One of the drivers of property price growth in Australia is growth in rental prices which is fueled by demand for rentals. Where does the demand for rentals come from? The rental market is divided up into a few different categories: there’s a pool of long term renters who will be renters for life, there are younger people who haven’t yet bought a property to live in, or have bought then sold properties and are in between, then there are new migrants who have moved here and are renting before buying.

The pool of new migrants is what we’re interested in, as these people demand rentals and also purchase properties. This means to stay in equilibrium for every family, couple or single person who moves into the state we need to have 1 more house listed for rent or for sale. In the 2022/2023 financial year we had net migration into WA of roughly 86,000 people. We can make some broad assumptions that this number is made up of mostly families, so we could assume for every 3 migrants we need 1 new house. That’s still 28,667 new houses needed last financial year just to stay in equilibrium. If we build 1 house less than this number, demand has started to outstrip supply. New building approvals for 2023 calendar year were approximately 14,000 which means we didn’t even build half of the houses necessary!

What about the replacement cost of houses or the time to bring on new supply? You’re not going to get much change from $300,000 if building a very basic, very small house in Perth in 2024. If you want any thing of size, or any bells and whistles you could comfortably spend upwards of $500,000 for a single storey house, make that $750,000 for a townhouse. You can still buy houses in the metro area for less than it costs to build them brand new…not as many as 18 months ago but they still exist. It doesn’t make sense that you can buy a house for less than it costs to build given the time value of money, or the complexity and risk that is inherent in the build process, so we must see an increase in house values to compensate for disparity with their replacement cost.

It takes anywhere from 9 months for a super simple, small, single storey house to be built, up to 2, 3, 4 or even 5 years for some houses that I’ve seen to be built! It depends upon the complexity of the project, approval times for council and state government, Western Power (our state electrical provider), Water Corp (our state water provider) and all the other myriad of contractors and regulatory bodies involved in the build and approval process. Building houses in Perth is a very complicated and long winded process, a housing shortage is definitely not a quick and simple fix in WA! That’s bad news for anyone trying to buy a house or find a rental, but good news for anyone that owns a property.

How do we fix the housing shortage? We need to build more houses. How do we build more houses? We need more trades who are capable of doing the work. Anyone who can swing a hammer gets paid handsomely to work in mining, so we’re drastically short of skilled trades, so in order to build more houses we need skilled migrants to come into the state. But wait, where are they going to live?! We have a housing shortage! Great question, unfortunately bringing in skilled trades will necessarily increase the population which will put further strain on the already undersupplied Perth housing market. It’s a necessary evil though in order to literally build our way out of this problem. We will see an increase in skilled migration, we need this. We will see further strain on the housing market with the influx of skilled migrants. We will see further upward pressure on house prices in Perth with the increase in population UNTIL such time as the supply that is being brought onto the market, built by the skilled migrants, is sufficient to bring the housing supply back into balance with the demand.

This has been a trend for few years now since 2017 when there was a glut of new builds, so we’re a few years behind on the necessary number of new houses. The Centre for Population predicts the WA net population growth to be 59,000 in the 2023/2024 financial year and 45,000 in the 2024/2025 financial year meaning on top of the 14,667 we didn’t build in the 2022/2023 financial year, we need an additional 34,666 over the next 2 years. So this shortage won’t be resolved until we can scale up building new dwellings enough to absorb the shortfall of dwellings needed to be built.

The large influx of migrants, combined with the low number of houses being built is squeezing the rental and housing market from both ends, which translates to an increase in housing prices.

One of the major concerns people have is that Perth is a mining town, it’s a single industry town and will boom and bust with mining. This is no longer the case. In 2014 when the previous market correction happened (or bust) there were multiple large mining and oil & gas projects which had been running for years, pumping huge volumes of cash into the economy which finished, and as a consequence the transient workers who were here only for these projects disappeared. When they left there was less demand for rentals, less demand for housing and consequently housing prices depressed. During this time, Sydney was going through a very large boom, meaning APRA wanted to control the Sydney house price inflation so they introduced very strong measures which impacted the whole of the country. WA was already in a lot of pain having lost a lot of the population who had been working on these large mining and oil & gas projects, and so when APRA turned off the supply of lending money from banks, it made it increasingly difficult to transact in property. This further depressed property prices and extended the downturn abnormally longer than it would have otherwise been.

We can see that mining is the second largest employer, but the top 5 employers only make up 50% of employment, meaning the state has significantly diversified employment prospects. When you add to this that the percentage employed in mining in 2013/2014 was roughly the same, however a large component of those employed were employed to construct the multiple massive projects underway at the time we start to get a picture that WA is no longer the same state that it was 10 years ago.

This is not the same, we don’t have the massive mining construction projects like Gorgon underway as WA has transitioned to an operator phase now which requires a steady and consistent number of employees, rather than a construction phase, and APRA isn’t restricting the supply of money like it did in 2017. Further the WA economy has diversified massively since then, meaning even if the mining sector did tank the number of people employed in mining isn’t significant enough to cause massive price depression like it did previously.

We can see that the housing crisis in WA isn’t a short lived problem and it isn’t going to be solved in 1 or 2, and probably not in 3 or 4 years, nor is this fueled by the same transient population growth as it was previously. Now is the time to capitalise on the unavoidable price increases in Perth in order to build your wealth and Retire Rich.

Reference